Corporate Social Responsibility

TISE is managed in a responsible and sustainable manner, supporting our transition to a low-carbon and sustainable economy

Corporate Sustainability

As part of our commitment to deliver a business model which is sustainable over the longer term, we are continuing to work toward our ambition of being Net Zero on Scope 1 and Scope 2 in our business operations by 2050. We have also committed to taking practical steps to minimise our Scope 3 (value chain) emissions, whilst offsetting any remaining Scope 3 emissions.

Our Business

Built on a culture of responsiveness and innovation, TISE provides financial markets and securities services to companies globally.

TISE is best known as one of Europe’s major professional bond markets. Issuers choose TISE because the products are provided through an efficient and cost-effective service from a venue which is internationally recognised and operates to global standards. TISE attracts issuers from around the world, including companies operating across a spectrum of environmental, social and sustainable sectors, such as, education, healthcare, municipal infrastructure, social housing and renewable energy.

We are a Partner Exchange of the United Nations’ Sustainable Stock Exchanges Initiative (UN SSE) and use feedback from our network to stay informed about industry developments and ensure that we retain our competitive edge. We work closely with our Listing Agents and Sponsors to deliver our market-leading listing service and have recently invested significantly in modernising our technology platform to help us deliver our services in a more efficient way.

Further information about TISE is available on the Company Profile page.

Our Environment

We are committed to being part of the sustainable capital markets ecosystem, both in terms of how we manage our business responsibly and facilitate capital flows into environmental, social and sustainable initiatives.

Supporting Sustainable Finance

TISE Sustainable is our comprehensive and reputable sustainable finance segment for our public market which facilitates the flow of capital into investments that promote environmental, social or sustainable activities.

Since launching in 2021, sustainable and ESG-rated issuers, green bonds, sustainable bonds, sustainability-linked bonds and humanitarian catastrophe bonds have been admitted to TISE Sustainable. Admissions to the segment slowed during 2022 and 2023, mirroring challenging conditions in the debt capital markets more broadly, but the revival in transactional activity in 2024, most evident within the high yield bond market, was reflected in an uptick in new admissions to TISE Sustainable.

During 2024 we welcomed new admissions to the segment from: VMED 02, a joint venture in the UK between the telecoms brands Virgin Media and 02; a green bond issued by a subsidiary of VodafoneZiggo; and a sustainability-linked bond issued by a subsidiary of Purmo Group, the pan-European provider of sustainable indoor climate products and solutions. At 31 December 2024, the total value of all listings on TISE supporting environmental, social and sustainable initiatives grew to £25.7 billion [31 December 2023: £20.5 billion], reflecting the continued increase in capital being allocated to these asset classes by a wide range of investor groups.

We continue to engage with our network at a local and international level to ensure that we are at the forefront of thought leadership and innovative action focused on facilitating sustainable investment. Whilst we continue to list securities which are not within the sustainable sector, we remain mindful of the need to appropriately manage and support issuers and investors with their transition to a low carbon and sustainable economy.

Further information is available on the Sustainable page.

Managing our Environmental Impact

We recognise the need to address climate change and will continue working to reduce the impact of our business operations on the environment. In 2023, we set out our Net-Zero targets and commitments focused on long-term value creation and preservation. Our target is to be Net-Zero on Scope 1 and 2 (operational) emissions by 2050. We have also committed to taking practical steps to minimise our Scope 3 (value chain) emissions, whilst offsetting any remaining Scope 3 emissions.

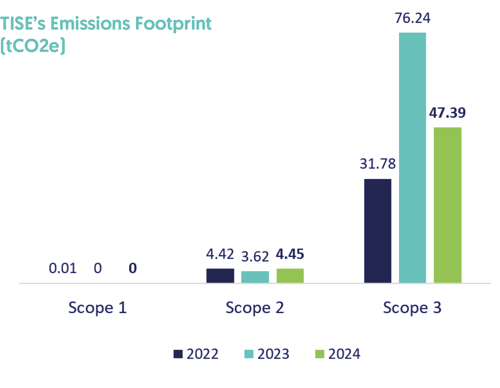

To enable us to measure progress against our Net-Zero targets and commitments, TISE undertakes a data gathering and emissions benchmarking exercise each year. Our reported emissions footprints for the first three years of measurement are shown in the adjacent graph.

Measured on a like for like basis, there was a significant decrease between 2023 and 2024 in the total reported emissions footprint. Value-chain emissions (Scope 3) continued to be the largest contributor to our footprint in 2024. We offset our reported Scope 3 emissions by supporting a gold standard offset project planting biodiverse forests in Panama. The project combines sustainable, high quality timber production with ecosystem restoration and provides long-term employment for the local population.

In 2023, our reported Scope 3 emissions increased significantly against the benchmark year (2022) because we collected data and reported on purchased goods (emissions from data centres, promotional merchandise and client drinks receptions) for the first time. In future years, as more data becomes available to us, we expect to continue to increase the breadth of our Scope 3 reporting.

Our Community

As the operator of an international exchange and an active participant in the global capital markets, we connect and engage with a broad range of external stakeholders, both large and small.

Providing Employment & Development Opportunities

Our success is founded in the quality of our staff. TISE offers unique career opportunities and employs staff with a diverse range of skills and experience. Our internal Career Development Programme is designed to attract and develop talent and we make a significant investment in staff training and professional development to help our staff progress in their chosen careers.

We are an equal opportunities employer and are committed to ensuring that all staff are treated fairly and with respect. Our employment policies follow best practice and, in so doing, ensure that staff are supported and protected in all aspects of their employment.

Our health and well-being programme is designed to support our staff both inside and outside of the workplace. Alongside private health insurance and dental insurance, we offer staff an annual subsidy which they can put towards supporting their wellbeing, for example, gym membership or yoga classes. TISE supports a number of initiatives aimed at maintaining staff wellbeing, including Mental Health Awareness Week, and several staff have received training as Mental Health First Aiders and Safer Spaces Champions.

Further information is available on the Careers page.

Partnering with our Communities

Our Corporate Social Responsibility (CSR) programme helps us to support and engage with the communities in which our staff live and work. Each year staff choose a local community project or not-for-profit organisation to partner with and provide support through both fundraising and volunteering days. All funds raised by our staff through CSR activities are matched by TISE. Our selected charity of choice for 2025 is the Guernsey Cheshire Home, which provides care and opportunities for people with serious physical difficulties.

Last year we raised more than £10,000 for Safer, a charity based in Guernsey which supports and empowers those experiencing domestic abuse. We also made smaller donations to charities providing similar services in Jersey and London.

We were also pleased to support our communities by providing corporate sponsorship for the Guernsey men’s netball team, Guernsey women’s team netballer McKenzie Rich, Guernsey women’s team footballer Scarlett Kenneally, the Jersey Hospice Ball, the Jersey International Air Display, the installation of a water fountain at St. Sampson’s Secondary School, world championship sailor Andrew Bridgman, and Vauvert Primary School’s Dragon Den competition.

Further information is available on the News page.

Careers

Our success is founded in the quality of our staff. At TISE we have a true passion for providing the right support for our staff so that they can achieve their full potential.

Careers

Europe’s most comprehensive sustainable market segment, enabling the flow of capital into investments that promote environmental, social or sustainable activities.

Sustainable