Kay McCarthy, Head of Jersey Office at The International Stock Exchange (TISE), explores how the local finance industry’s sustainable finance initiatives are helping the global transition to a lower carbon, more sustainable way of life.

In 2023 we are all much more aware than previously of how the actions we take can assist in the collective efforts to address climate change as we “walk the walk” by evolving our way of life so that we reach carbon neutrality by 2050.

The financial services sector locally is actively helping to move the global economy and society to a more sustainable footing by providing a range of sustainable finance initiatives to facilitate the flow of capital into activities aimed at assisting the transition to net-zero.

The Channel Islands have been at the forefront of regulatory and commercial developments in the sustainable finance sphere. Yet, the landscape is far from static and there are global developments which we will need to monitor in the context of our particular financial services sectors if we are to continue to lead the way in the future.

All change

In the decade leading up to 2022, sustainable finance enjoyed seemingly unstoppable growth as regulators, companies and investors sought to address the climate crisis and investors poured capital into this asset class.

"In the decade leading up to 2022, sustainable finance enjoyed seemingly unstoppable growth."

The conflict in Ukraine changed this and brought about an energy crisis which prompted concerns around the security of energy supply and raised serious questions about the commitment to reducing the reliance on fossil fuels. The energy crisis also precipitated a spike in prices, stoked inflation and consequently prompted central banks to hike interest rates. This new paradigm generated significant uncertainty over the future direction of rates and therefore the pricing of credit and assets, squeezing the supply of sustainable investment opportunities in a market which has historically seen heavy investor demand.

Sustainable bond trends

Data from the Climate Bond Initiative (CBI) shows that the issuance of green, social, sustainable, sustainability-linked and transition bonds fell for the first time in more than a decade during 2022. Year-on-year growth in this sector had been maintained for over a decade and culminated in a record 2021, when volumes topped $1 trillion. This fell during 2022 to around $860 billion but kept a 5% share of the total bond market and took total lifetime volumes of all these forms of sustainable debt to more than $3.7 trillion.

A new report from S&P Global Ratings projects that sales will rise again this year and are projected to be between $900 billion and $1 trillion in 2023. A key driver is expected to be traditional ‘use of proceeds’ bonds, such as green, social or sustainable bonds, which require companies to use the proceeds raised from a bond issuance to finance specific projects.

"Sustainability-linked bonds, which require companies to meet specific sustainability performance targets or face increased coupon rates on payments to bond holders, are the most dynamic product in the market currently."

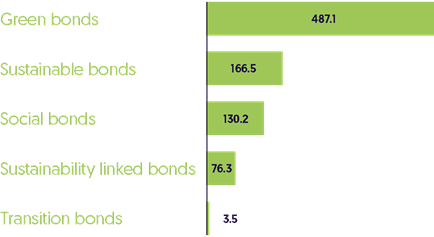

Green bonds continue to make up more than half of the total market. Social bond issuance peaked and tapered in tandem with the effects of the pandemic and has been superseded by increased demand for sustainable bonds. Sustainable bonds meet both environmental and social concerns, for example financing public housing, schools, hospitals and bother municipal infrastructure projects. Sustainability-linked bonds, which require companies to meet specific sustainability performance targets or face increased coupon rates on payments to bond holders, are the most dynamic product in the market currently. According to S&P, volumes rose more than 10-fold from 2020 to 2021 to reach $94.4 billion and although they slipped back last year, they are expected to be in-demand once more this year.

CBI data shows that the nascent transition bonds sector saw volumes of just $3.5 billion in 2022 but a recent report from the Bank of America suggests that market demand for transition bonds is gaining momentum as issuers respond to investor demand for diversification of their investment allocations across a broader range of environmental and social outcomes.

Breakdown of sustainable bond issuance, 2022 (US$ bn)

Source: Climate Bonds Initiative

TISE Sustainable

These are trends which are familiar to us at TISE. Our comprehensive and reputable sustainable finance segment, TISE Sustainable, was launched in 2021. Since then, green bonds, sustainable bonds, sustainability-linked bonds and humanitarian catastrophe bonds have been admitted to TISE Sustainable.

In 2022, there were new admissions from brands such as Dutch telecommunications group VodafoneZiggo, the UK’s leading independent leasing, fleet management and vehicle outsourcing business Zenith, and renewable energy infrastructure investor Bluefield. Reflecting the wider market conditions, admissions to TISE Sustainable slowed through last year and so it is pleasing that we started 2023 with the listing of a sustainability-linked bond issued by Costa Rican telecommunication brand, Liberty Costa Rica.

"We anticipate that sustainability-linked bonds will continue to be a growth area, and we are also closely monitoring the volumes in transition bonds."

We anticipate that sustainability-linked bonds will continue to be a growth area, and we are also closely monitoring the volumes in transition bonds. Responding to the demand from market participants referenced in the report by the Bank of America, we launched a new transition offering within TISE Sustainable last October. Catering for transition bonds and transition issuers, it means we can further support initiatives which lead to a lower carbon economy and society as part of the hugely important efforts to secure a just transition to net-zero.

At 31 December 2022, there was £13 billion of listings on TISE supporting environmental, social and sustainable initiatives. This demonstrates how, as a Partner Exchange of the United Nations’ Sustainable Stock Exchanges Initiative (UN SSE), we can be at the forefront of sustainability as a facilitator of global capital flows.

The Channel Islands

As a key component of the local financial services infrastructure, our offering at TISE – including TISE Sustainable – complements the other elements of the sustainable finance ecosystem across the islands. We are delighted to continue to participate in sustainable finance working groups providing market data, commentary and insight for communications and offering sponsorship and speaking support.

"The financial services sector locally is actively helping to move the global economy and society to a more sustainable footing by providing a range of sustainable finance initiatives."

The Channel Islands have been leaders in sustainable finance initiatives, but we cannot be complacent, and we must ensure we are addressing the latest developments in a manner appropriate for our industry. The war in Ukraine appeared to slow the moves towards mandatory, unified sustainability standards but the growing adoption of the Task Force for Climate-related Financial Disclosures (TCFDs) and a ramping up of activity by the International Sustainability Standards Board (ISSB) demonstrates that, if anything, that was just a brief pause.

Similarly, whilst the macro-economic environment remains uncertain, we anticipate that as conditions improve debt capital markets will open up, providing a boost to the sustainable bond market as the year progresses.

This article was originally published in Connect Magazine, Sustainability Feature, April 2023

Kay McCarthy

Head of Jersey Office